- test

- Avia Masters in India Crash Game Dynamics and Betting Strategies

- Avia masters Casino igra z RTP 97%

- Going for The fresh Web based casinos in the Ca: Helpful tips to have 2025

- ten Finest Crypto Casino Betting, Playing United states Sites out of 2025

- Verbunden Kasino Provision ohne Einzahlung originell! 2025

- Jobb valódi pénzes online kaszinók az USA-ban Játssz és nyerj valódi pénzt

- Finest Web based casinos for your Area, Incentives & Earnings

Professional Guidelines for Forex Trading Framework 1722455672

Professional Guidelines for Forex Trading Framework

In the fast-paced world of forex trading, developing a robust trading framework is crucial to achieving success. A well-structured approach enables traders to navigate the complexities of the market with confidence. In this article, we will delve into the essential guidelines needed to create an effective forex trading framework, including market analysis, risk management, and trading strategies. For more resources, visit forex trading framework professional guidelines forex-level.com.

Understanding the Forex Market

The forex market operates 24 hours a day and is the largest financial market in the world. Understanding its dynamics is fundamental for any trader. Three primary components make up the forex market: currency pairs, the impact of economic indicators, and geopolitical influences. Currency pairs indicate the relative value of one currency against another, and trading these pairs requires a solid grasp of market sentiment and trends influenced by the global economy.

Setting Up Your Trading Framework

Your trading framework should encompass various elements that work together to create a comprehensive trading strategy. Here are the key components to consider:

- Market Analysis: Conduct thorough technical and fundamental analysis. Use charts, trends, and indicators to make informed decisions.

- Risk Management: Establish rules for managing your capital and setting stop-loss orders to protect your investments.

- Trading Plan: Create a detailed trading plan that outlines your goals, strategy, and the criteria for entering and exiting trades.

- Emotional Discipline: Develop the psychological traits necessary to remain calm under pressure, avoid impulsive trades, and adhere to your trading plan.

Market Analysis Techniques

Technical Analysis

Technical analysis involves evaluating historical price data to predict future movements. Traders often use indicators such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels to identify patterns and trends. Here are some technical analysis techniques:

- Chart Patterns: Recognize patterns such as head and shoulders, triangles, and flags to identify potential reversal or continuation points.

- Indicators: Utilize various indicators to assess market momentum, volatility, and direction. Customizing your indicators based on your trading style can enhance your analysis.

- Support and Resistance Levels: Identify key support and resistance levels where price is likely to reverse or consolidate.

Fundamental Analysis

Fundamental analysis focuses on economic indicators, interest rates, and geopolitical events that impact currency values. Traders should monitor central bank announcements, inflation rates, employment data, and political stability to better understand market sentiment. Significant economic reports often lead to increased volatility, presenting trading opportunities.

Risk Management Strategies

Effective risk management is pivotal in forex trading, and it helps traders minimize losses and protect capital. Here are some common risk management strategies:

- Position Sizing: Determine the appropriate position size based on your risk tolerance and the size of your trading account. A common rule is to risk no more than 1-2% of your capital on a single trade.

- Setting Stop-Losses: Use stop-loss orders to limit potential losses in case the market moves against you.

- Diversification: Spread your investments across different currency pairs and trading strategies to mitigate risk.

- Regular Assessment: Continuously evaluate your trading performance and adapt your risk management strategies accordingly.

Developing a Trading Plan

A well-crafted trading plan serves as a roadmap for your trading endeavors. It should be tailored to your individual goals and risk tolerance. Your trading plan should include:

- Trading Goals: Identify specific financial goals you wish to achieve, both short-term and long-term.

- Entry and Exit Criteria: Clearly define the conditions for entering and exiting trades based on your analysis.

- Risk Management Rules: Outline your risk management strategies, including how to set your stop-loss orders and determine position size.

- Review Process: Implement a regular review process to evaluate your trading performance and make necessary adjustments.

Maintaining Emotional Discipline

Emotional discipline is an essential component of successful trading. It’s easy for emotions to influence trading decisions, especially during periods of high volatility. Developing emotional discipline involves:

- Sticking to Your Plan: Commit to your trading plan and avoid making impulsive decisions based on emotions.

- Recognizing Trading Traps: Be aware of psychological biases that can lead to poor trading choices, such as the fear of missing out (FOMO) or overconfidence.

- Practicing Mindfulness: Techniques such as meditation or focusing on breathing can help keep emotions in check during stressful trading situations.

Continuous Learning and Adaptation

The forex market is ever-evolving, and successful traders must remain adaptable. Continuous learning and improvement are vital. Here are some strategies to enhance your knowledge and skills:

- Education: Invest time in trading courses, webinars, and literature to improve your understanding of market dynamics.

- Networking: Engage with other traders to exchange insights and strategies. Online forums and trading communities can be valuable resources.

- Backtesting: Utilize historical data to backtest your trading strategies and assess their effectiveness before implementing them in live trading.

Conclusion

Building a professional forex trading framework is essential for achieving consistent success. By combining market analysis, risk management, and emotional discipline, traders can enhance their decision-making and improve their overall performance. Remember that trading requires patience, practice, and perseverance, so stay committed to your trading journey. With the right framework and mindset, you can navigate the complexities of the forex market and work towards your financial goals.

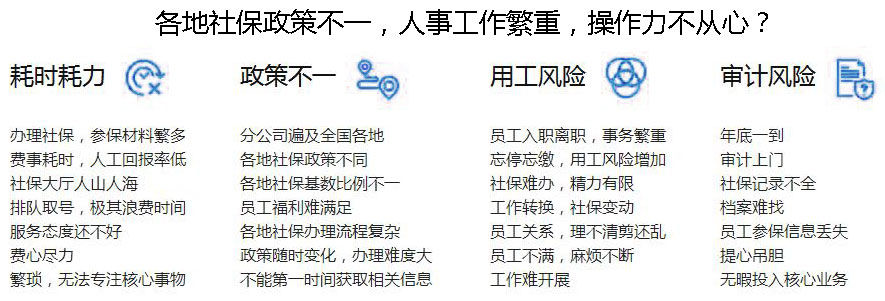

常见社保问题:

Q1:社保代理合法吗?

A1:合法。

相关法律:《劳动保障事务代理暂行办法》第二条规定“本暂行办法所称的劳动保障事务代理,是指劳动保障事务代理经办机构,根据协议,接受用人单位或劳动者个人的委托,在一定期限内为委托方代管劳动者个人档案、代办劳动人事、社会保险等劳动保障事务的行为”

A2:社保代理收费标准为19.8元/月起,代理办理社保相应服务,主要有:

1.工伤认定、评级、报销手续;

2.养老退休手续;

3.生育津贴、产前检查费报销、申领手续;

4.参保人员的医疗费报销;

5.失业保险金领取手续

6..……

A3:养老保险需要交满15年。养老金领取按当地社保领取政策为准。

A4:医保具体连续缴纳时限,各地社保政策有不同的规定,成都规定要连续缴纳12个月。医保断缴后即暂停享受医保待遇,欠费3个月以内补缴的,不算断缴,可连续享受社保待遇,欠费4个月以上的视为中断。

A5:生育保险要连续交满12个月,才能享受生育待遇。生育保险具体报销标准应看各地社保政策规定。